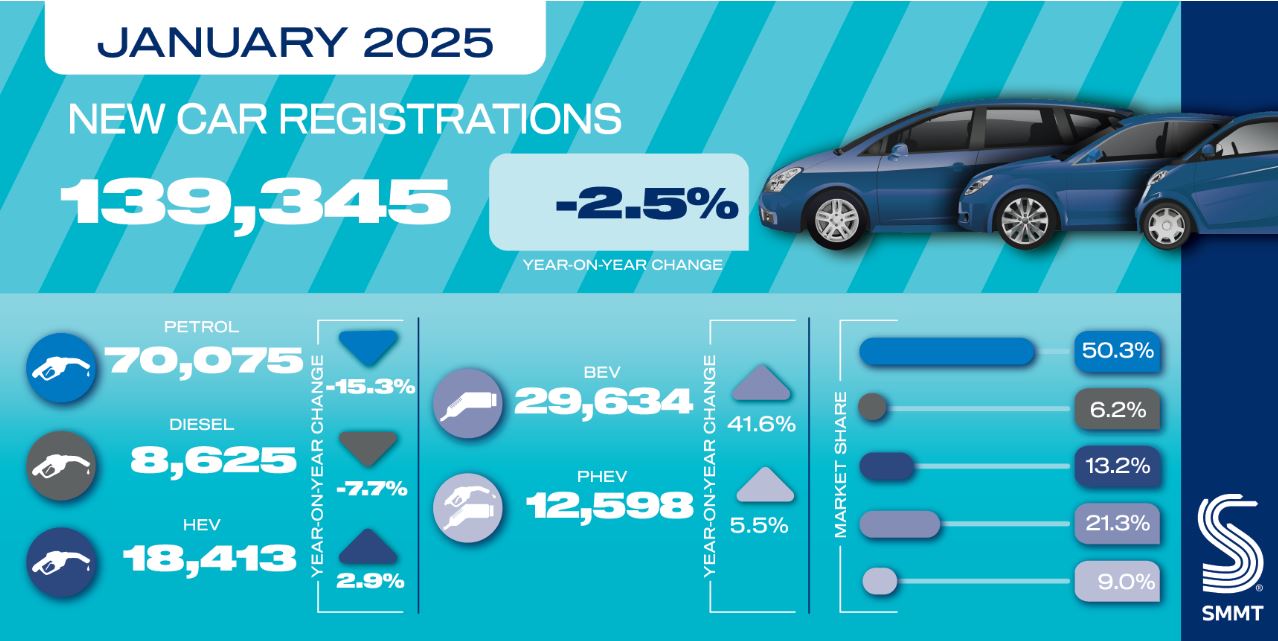

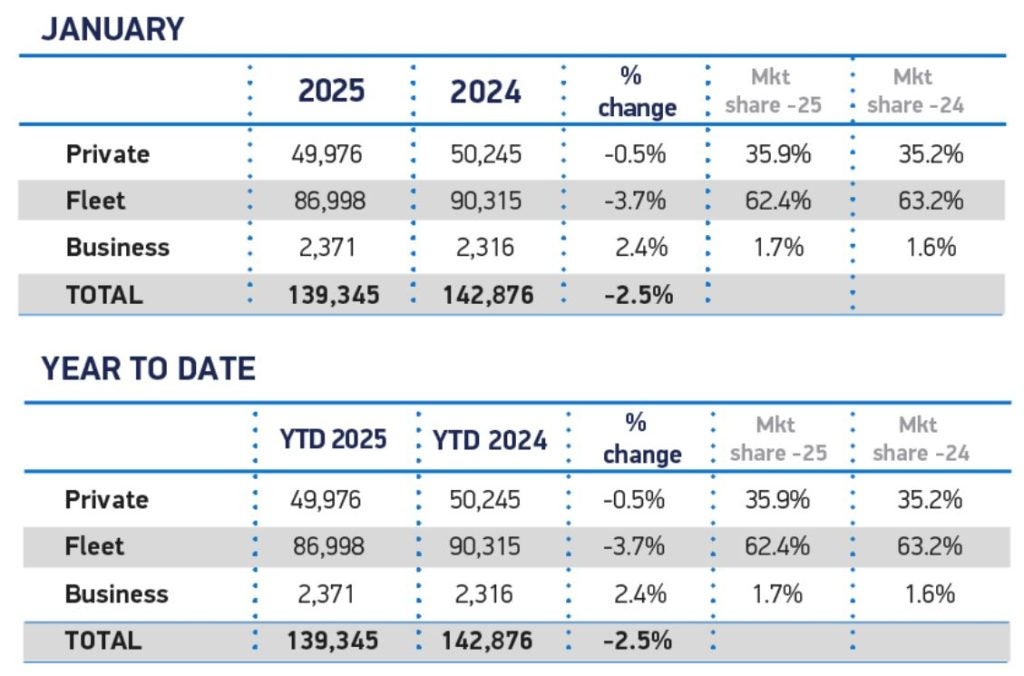

The UK’s new car market saw a 2.5% decline in January, with registrations falling to 139,345 units, according to data from the Society of Motor Manufacturers and Traders (SMMT). The latest figures mark the fourth consecutive month of decline, attributed to weak consumer confidence and challenging economic conditions.

Both fleet and private registrations fell, by 3.7% and 0.5% respectively, while business registrations saw a modest 2.4% rise. Petrol and diesel car sales continued to drop, with petrol down 15.3% to 50.3% market share and diesel falling 7.7% to 6.2%. Meanwhile, hybrid electric vehicles (HEVs) and plug-in hybrids (PHEVs) recorded growth, capturing 13.2% and 9.0% of the market, respectively.

Battery electric vehicles (BEVs) continued their upward trend, rising 41.6% year-on-year to account for 21.3% of all new car sales. Despite this growth, BEV sales remain below the government’s 22% target for 2024 and are even further from the 28% required in 2025 under the Zero Emission Vehicle (ZEV) mandate.

“The significant surge in EV sales last month will come as some relief to manufacturers,” said Ian Plummer, commercial director at Auto Trader. “If the market is to meet the required 28% ZEV target, there’ll be no let-up in pressure to maintain electric vehicle demand, likely resulting in very competitive offers to entice buyers over the coming months.”

The introduction of Vehicle Excise Duty (VED) for EVs in April has raised industry concerns, as higher production costs mean many electric models will exceed the £40,000 threshold for the ‘Expensive Car Supplement’. The change will see buyers facing an additional £3,110 tax bill over the first six years of ownership, compared to zero at present.

“Although electric vehicle sales are encouraging, these continue to be elevated by fleet sales, and consumer appetite for EVs needs to rise faster,” said John Cassidy, managing director of sales at Close Brothers Motor Finance. “With a developing charging infrastructure and widespread reservations on EVs’ range, it’s imperative that incentives for EV ownership are not neglected.”

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free

sample

Thank you!

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

Beyond taxation, infrastructure remains a critical issue. Jamie Hamilton, automotive partner at Deloitte, highlighted that 80% of prospective EV buyers intend to charge at home, leaving those without driveways at a disadvantage. “A robust and reliable public charging network is essential to give all drivers the confidence to make the switch,” he said.

Despite these challenges, industry figures suggest growing consumer interest in EVs. Philipp Sayler von Amende, chief commercial officer at Carwow, noted a 29% year-on-year increase in BEV enquiries through the platform in January, adding that “this strengthening interest in BEVs will be welcome news to OEMs as they strive to meet stricter ZEV targets.”

The outlook for 2025 remains uncertain, with manufacturers facing increasing regulatory pressures and global trade tensions. Auto Trader‘s Commercial Director Ian Plummer noted that competition from Chinese brands, economic uncertainty, and US trade policies could all impact the market in the coming months.

He said: “Coupled with uncertainties surrounding the economy, compounded by concerning rhetoric from the US, 2025 will offer its fair share of challenges, particularly established brands which face fierce competition from a growing array of new Chinese entrants. For consumers, however, the combination of major offers and new players vying for their attention could make 2025 a very attractive time to buy a new electric.”