Certified pre-owned vehicle sales are projected to decline in 2025 amid tight supply that has driven down sales at major manufacturers in 2024.

Toyota expects about a 14% year-over-year decrease in certified pre-owned (CPO) vehicle sales at yearend 2024 to between 325,000 and 330,000, Brett Keckeisen, a member of the Toyota Certified Used Vehicles (TCUV) team, told Auto Finance News. The decrease is driven by limited and costly inventory, exacerbated by vehicle recalls across the industry, he said.

“There’s such little inventory out there for dealers to acquire,” Keckeisen said. When dealers do get access to supply, “they have to pay so much to acquire the inventory, it’s hard for them to justify the purchase,” he added.

“There’s such little inventory out there for dealers to acquire.” — Brett Keckeisen, Toyota Certified Used Vehicles

Sales of Nissan CPO vehicles have also seen some “softening” in 2024 amid fluctuating used-car prices and limited availability, Kevin Cullum, president of captive Nissan Motor Acceptance Company, told AFN. He did not provide volume specifics but noted CPO sales are “flat” this year and are expected to be flat to down in 2025 as new-vehicle sales grow.

Despite a downtick YoY, American Honda projects total CPO vehicle sales across Honda and Acura to rise 5% YoY in 2025, Dan Rodriguez, director of auto remarketing at American Honda Motor Co., told AFN.

Year to date through November, Honda and Acura CPO vehicle sales combined sat at 277,520 units, according to the company. By comparison, Honda and Acura CPO sales rose 16% YoY to more than 340,000 units in 2023, Rodriguez previously told AFN.

CPO sales projected down 1.6% YoY

Industrywide CPO sales are expected to tick down 1.6% YoY in 2025 to 2.5 million units even as total used-vehicle retail sales are projected to increase 1.2% YoY to 20.1 million units, Jonathan Smoke, chief economist at Cox Automotive, said during the company’s Dec. 17 industry insights and 2025 forecast call.

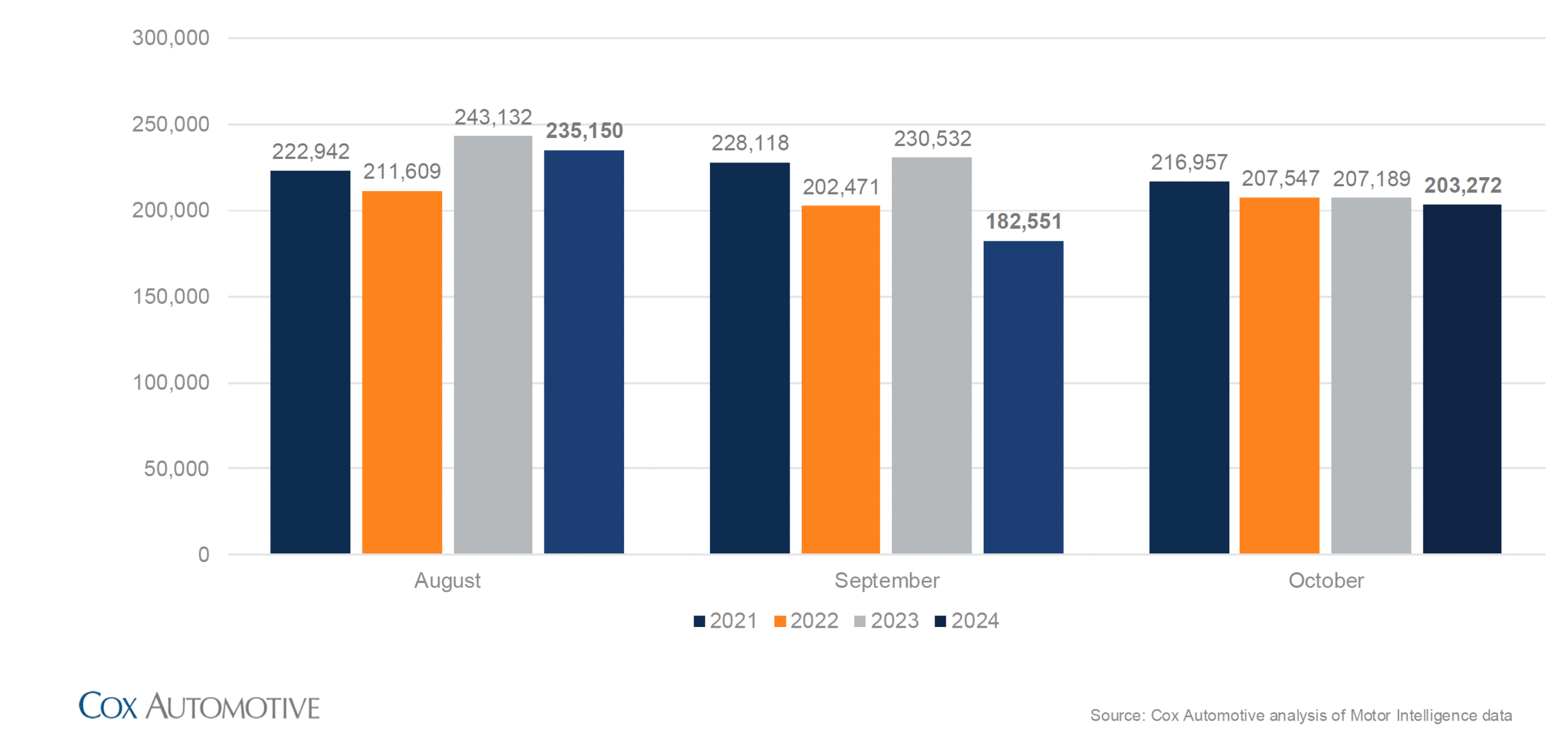

In October, CPO vehicle sales totaled 203,272 units, down 1.9% YoY but up 11.4% month over month, according to the latest data published Nov. 15 by Cox Auto. Year-to-date CPO sales through October were down 3.9% YoY, with Cox forecasting 2.6 million sales by yearend.

CPO sales October 2024

“It’s still a strong CPO year for the market,” NMAC’s Cullum said. “[But] with off-lease supply coming down, it’s making CPO more challenging.”

Inventory a challenge

New-vehicle production slumps in 2020 and 2021 continue to impact the supply of newer used vehicles, Jeremy Robb, senior director of economic and industry insights at Cox Auto, said during the call.

Supply of off-lease vehicles, which are a large feeder of CPO vehicle inventory, is expected to remain constrained until at least April 2026, he said.

“In 2021 when we didn’t have new vehicles produced and the sales were low, manufacturers lowered the incentivizing that they did, on leasing in particular. Leases are expensive products to offer,” Robb said.

“Most leases are three-year leases. … We’re living in the low period for the next year where we’ll see smaller levels of supply come into the wholesale market from off-lease and then into the retail market.”

Expanded programs

Many manufacturers are looking at ways to bring older vehicles into their CPO programs to meet demand, Robb said. CPO is “in demand from consumers because there are extra assurances from the OEM and it’s more affordable than a new car,” he said.

American Honda expanded its CPO program to include models up to 10 years old with the March 2022 launch of HondaTrue Used and Acura Precision Used. Sales under those programs have risen 22% since the launch, Rodriguez said.

The OEM is seeing high CPO demand combined with limited inventory, he said, adding that while inventory has been “challenging,” supply has improved in the past two months and “consumer click and search interest” is high.

“CPO demand is especially strong with Google inventory search demand outpacing last year,” Rodriguez said. “Our vehicles are turning much more quickly than last year, with our national inventory turning every 25 days.”

American Honda has also leaned into CPO leasing and will expand all programs in 2025 while developing tools to make it easier for dealers to calculate residual values, Rodriguez said.

Toyota expands CPO

In early 2024, Toyota expanded the TCUV vehicle program to include cars up to 10 years old with between 60,000 to 125,000 miles, dubbed Silver Certified, according to the OEM. Toyota’s Gold Certified program covers cars up to six years old and 85,000 models.

“We’re getting more dealers on board [with Silver] every month,” TCUV’s Keckeisen said, adding that buying a 10-plus-year-old vehicle for inventory takes some adjustment.

In 2025, CPO sales industrywide are likely to maintain versus seeing a large uptick, Keckeisen said. “It’s going to be hard to acquire many vehicles to certify and sell.”

Register here for the free Auto Finance News webinar “Tapping Aftermarket Products to Improve Dealer Relations and Profitability,” taking place on Tuesday, Jan. 14, at 10:45 a.m. ET.