UK banks’ provisions for the ongoing probe into motor finance commission arrangements and related operational costs are expected to surpass £2 billion in 2025, according to Fitch Ratings.

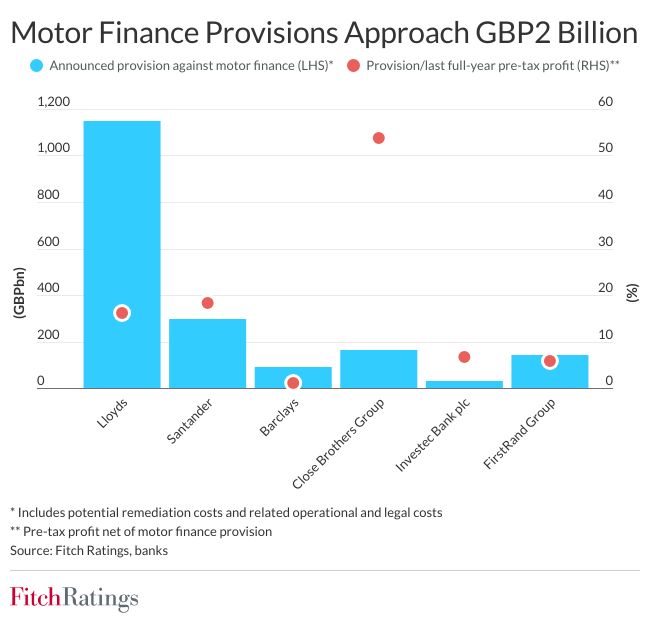

Lloyds Banking Group, the UK’s largest motor finance provider, has set aside an additional £700 million in its fourth-quarter 2024 results to cover potential remediation costs, adding to the £450 million provision made in the previous year. Other lenders, including Santander UK (£295 million), Close Brothers Group (£165 million), Barclays (£90 million), FirstRand Group (£140 million), and Investec Bank plc (£30 million), have also increased their provisions following the UK Court of Appeal’s ruling in favour of customers in October 2024.

The ruling found that lenders had failed to adequately disclose commissions paid to car dealerships for arranging loans, raising the likelihood of customer compensation. Fitch noted that banks’ provisions mainly account for operational and legal costs under various scenarios, but final financial impacts remain uncertain. Key factors include the compensatory loan interest rates applied, the rate of claims, and operational costs per claim.

While major UK banks — excluding NatWest and HSBC, which have no exposure — have made provisions, Fitch stated that the impact on their capital remains limited due to strong pre-impairment profits and capital buffers. However, medium-sized lenders face greater risks due to lower profit levels and higher exposure to motor finance. Close Brothers Group, in particular, remains on Rating Watch Negative due to the financial impact of the ruling.

The case is currently under appeal to the Supreme Court, with a hearing scheduled for April. The Financial Conduct Authority (FCA) is also reviewing historical commission practices and is set to issue guidance in May, though this could be delayed pending the Supreme Court’s decision.

Fitch said it expects continued uncertainty over the ultimate cost of redress, with a prolonged review process potentially leading to greater financial and operational pressures for affected lenders.