- New executive order temporarily pauses federal loans and grants, potentially impacting funding for both students and colleges.

- The freeze likely includes programs like Pell Grants, potentially affecting students who rely on need-based aid.

- Colleges could face financial strain as expected federal funds are delayed, leading to uncertainty in institutional budgets.

An executive order issued last night by the Trump administration has placed a temporary freeze on federal financial loans and grants. The order takes effect at 5pm on January 28, 2025, so any grants or loans disbursed before then should proceed normally.

While the order aims to review government spending, the move has sparked concerns among students and colleges that this order could impact tuition payments, financial aid packages, and institutional operations.

While the order is not clear and there is some discretion among agencies, the order says that payments to individuals should continue, while other payments should be paused pending review. Since Pell grants and other educational grants are NOT payments to individuals, they may be paused.

However, student loans are a gray area. These loans are taken out by individuals, but they are disbursed to schools first. Whether these will be paused remains to be seen.

Are Pell Grants Affected?

Perhaps the most immediate concern is the impact on federal grants, particularly the Pell Grant program, which provides need-based financial aid to millions of low-income students. Since grants are distributed through colleges, a freeze on federal assistance could disrupt the flow of funding, leaving students without expected aid.

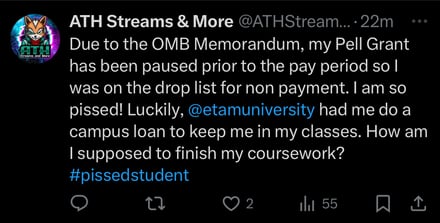

Without these funds, colleges may be unable to distribute financial aid packages as planned, causing some students to reconsider their enrollment options or take on more private loans to cover gaps in funding. Some users on X are already reporting issues with their grants:

How Federal Student Loans Could Be Impacted

The executive order directs federal agencies to pause “all activities related to obligation or disbursement of all Federal financial assistance.” While the administration states that this will not impact direct individual benefits like Social Security or Medicare, student loans may face delays or restrictions.

Student loans are borrowed in an individual’s name, but they are disbursed first to colleges and universities.

For borrowers, this could mean uncertainty around loan disbursements, especially for those who rely on federal loans to pay for their education. If the freeze extends beyond a temporary review, students may need to seek alternative funding sources to cover tuition and living expenses.

Colleges Face Uncertainty

Beyond students, colleges and universities could experience financial strain if federal grants and loans are delayed. Many institutions depend on these funds to support their budgets, maintain academic programs, and sustain operational costs. Without federal assistance, some schools may face funding gaps that could lead to reduced services, staff furloughs, or increased tuition costs for students.

While the administration has suggested that the freeze is temporary, there are concerns that it could set a precedent for further restrictions on federal education funding. Colleges, particularly those with a high percentage of low-income students, may need to adjust financial aid strategies to compensate for potential delays or reductions in federal support.

What’s Next?

The White House has not provided a clear timeline for when the review will be completed or when funds will be released. Lawmakers have already begun raising concerns about the legality and potential consequences of the freeze, with some warning that it may face legal challenges.

For example, Senator Chuck Schumer said in a statement that the order may violate the Impoundment Control Act of 1974.

Students and colleges should monitor updates from the Department of Education and financial aid offices for guidance on how to navigate potential disruptions. Those affected should also explore alternative funding sources, such as institutional aid, work-study programs, or emergency grants, while waiting for clarity on federal financial aid programs.

Don’t Miss These Other Stories: