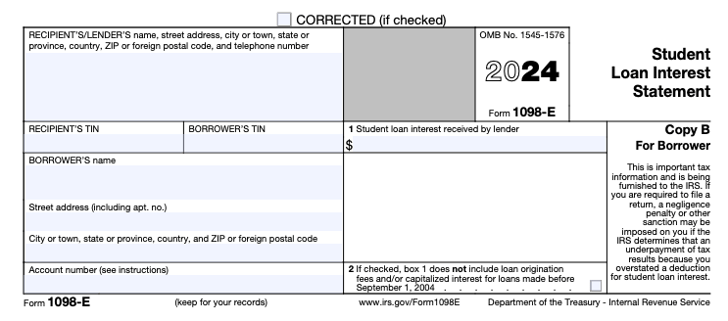

The 1098-E form is what you receive for tax season if you paid more than $600 in student loan interest last year.

Receiving a 1098-E form may allow you to deduct student loan interest on your federal tax return. This deduction can reduce your taxable income by up to $2,500, offering some financial relief for those managing student loan debt.

Today, we break down what the 1098-E is, and how it impacts your taxes so that you can potentially claim the student loan interest deduction.

Who Qualifies To Take The Student Loan Interest Deduction?

To take the student loan interest deduction, you must pay at least $600 in student loan interest. You can only deduct up to a maximum of $2,500 in interest paid.

The student loan interest deduction is an adjustment of your gross income. So if you paid $2,500 in student loan interest, and you earned $60,000, you’ll only pay taxes on $57,500.

For the purposes of the deduction, it doesn’t matter whether your loans are federal loans or private student loans. Both qualify for the deduction.

The student loan interest deduction goes to the person who is legally required to pay the student loans. That means, if your parents took out loans for you, they get the deduction. This is even true if you make the payments for the loans.

Married borrowers must opt to file taxes as married filing jointly if they want to qualify for the deduction.

The student loan interest deduction is also affected by your income. It is a deduction with a “phase out period” which means as your income grows, you may have a lower deduction.

The table below shows how your income affects your ability to take a deduction for 2024 (when you file in 2025):

|

Deduction Relative to Earnings |

|

|---|---|

|

Less than $80,000- Full Deduction $80,000-$95,000- Partial Deduction More than $95,000- No deduction |

|

|

Earning less than $165,000- Full Deduction $165,000-$195,000- Partial Deduction More than $195,000- No deduction |

Since the deduction is based on a Modified Adjusted Gross Income (MAGI) you need to do a bit of math to determine your income. All the major tax software packages will appropriately calculate your student loan interest deduction.

How Do I Know If I Qualify For The Student Loan Interest Deduction?

If you meet or exceed the $600 interest requirement, your student loan servicer should mail you a copy of a 1098-E form. Box-1 of the 1098-E form contains the total interest you paid on your loans in the previous year.

People with multiple student loan servicers may not automatically receive their 1098-E forms if they paid less than $600 in interest per servicer. In those cases, call your loan provider for more information and to ask them to issue you the form. While you don’t need the form to complete your taxes, it’s a lot easier than trying to figure out the amount of interest you paid on your own.

Impact Of The Student Loan Pause

While the student loan pause officially ended in 2023, many borrowers did not have to make payments through 2024 due to ongoing lawsuits and forbearance. The result of this is that many borrowers might not have PAID $600 in interest in 2024.

It’s important to note that you can deduct ANY student loan interest paid, even if you didn’t receive a 1098-E. For example, if you only paid $100 in interest, you won’t get a tax form. However, you can deduct that on your taxes.

Make sure you keep your student loan statements as proof.

How To Use The 1098-E Form?

The 1098-E form is a very basic form that contains your personal information and the amount of interest you paid to the lender. If you receive multiple 1098-E forms, you will need to add the amounts in Box-1 of the forms to determine your total amount of interest paid.

Remember, you can deduct up to a maximum of $2500.

If you’re using a tax software to do your taxes, the software will automatically calculate your deductions. However, if you’re hand filing your taxes, you’ll need to enter your total interest paid on your form 1040.

Since the student loan interest deduction is an above the line deduction, you don’t need to worry about an entire itemization schedule.

Have you ever claimed the student loan interest rate deduction?