FP Answers: Earning $95,000, 61-year-old with $200,000 mortgage and $40,000 savings wonders how to handle retirement

Article content

Q. I’m 61 years old and working full-time earning $95,000 annually. I have worked full-time for the past 30 years and made the maximum Canada Pension Plan (CPP) contributions during that time. I have a mortgage of $200,000, plus annual bills of $25,000. I have no other debt. I also have very little in the way of savings. I have no registered retirement savings plan (RRSP), no non-registered investments and no employer pension plan. My only savings are $40,000 that I have in a chequing account, mostly for emergencies and to replace my seven-year-old car when the time comes. Should I apply for CPP now and use the funds to invest or pay down my mortgage? Should I wait until age 65 to collect CPP, or later? I plan to continue working until at least age 65 but could work longer at my management job if needed. — Naomi

Advertisement 2

Article content

Article content

Article content

FP Answers: Naomi, although you are asking about the CPP, I wonder if instead you should be considering the Guaranteed Income Supplement (GIS). The GIS is a benefit designed for low-income seniors, but it is available to anyone over age 65 with a low taxable income. There is a difference between low income and low taxable income. Naomi, think about how you can have a relatively high retirement income while at the same time a low taxable income. This will allow you to maximize government pension benefits.

The three main pensions available to you are the CPP, Old Age Security (OAS), and the GIS. The GIS becomes available once you start your OAS pension. It is a tax-free supplemental pension designed for people with a low income and the amount you will receive is based on your marital status, taxable income, and years in Canada. Here is a link to the GIS tables where you will find an estimate of what you might receive. The amount a single person can receive is different from what a couple can receive.

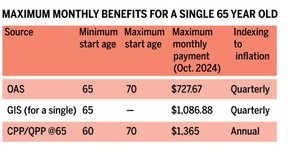

The accompanying table shows the maximum monthly pension you can receive and the frequency of adjustments. CPP is based on contributions, and OAS is based on years lived in Canada, with a clawback starting at $93,454. The GIS is also based on years in Canada, but also on taxable income, and there is a clawback of $1 for every $2 of income. A single person with no taxable income, other than what is exempt, will earn the maximum GIS. Once a single person’s taxable income hits $22,056, all of the GIS is clawed back. Note that you can’t add all three benefits together and assume that is what a senior with no income will earn, because the CPP will cause a GIS clawback.

Article content

Advertisement 3

Article content

Taxable income comes mainly from interest, dividends, capital gains, employment and rental income, and registered retirement income fund (RRIF) withdrawals, but there are exemptions. The main exemptions are your OAS income, the first $5,000 of employment income, and 50 per cent of employment income earned between $5,000 and $15,000.

Naomi, let’s walk through a couple of examples. If I assume your CPP at 65 is $13,000 a year and it is your only taxable income because the OAS is excluded, your GIS will be $377.52 a month or $4,530 a year. And remember, the GIS amount is non-taxable. Your total pre-tax income with CPP, OAS, and the GIS is $26,262 and the after-tax amount in Ontario is $26,156.

Now, in a second example, let’s assume you have a RRIF from which you draw $5,000 a year. Your GIS would now be reduced from $4,530 a year to $2,022 a year and you would pay additional tax of $323, for an effective tax rate of 56.62 per cent. Now, if instead of drawing $5,000 from a RRIF, you earn $5,000 and would get the full GIS of $4,530 because the first $5,000 of employment income is exempt from the qualification equation.

Advertisement 4

Article content

Planning around the GIS and low taxable income is tricky. Probably the first question to ask is: Will you always be in a relatively low tax bracket? If the answer is yes, then what is the best way to save for your future?

Should you contribute to a tax free savings account (TFSA) or an RRSP? The easy answer is the TFSA contributions because the growth and withdrawals are tax-free. In some cases, it may make sense to make RRSP contributions while working but not claiming the deduction until you have retired so you can reduce your income and qualify for the GIS.

Recommended from Editorial

-

How should Eleanor invest so she can retire early?

-

What should our cash flow strategy be in retirement?

-

Should I get back into the market after I pulled out?

Intentionally starting CPP early to create a smaller pension and less tax may mean a larger GIS. Should you keep your home or sell and rent? Keeping it means you can draw tax-free money from your home equity with a line of credit or reverse mortgage, which might mean potentially more GIS. Selling means investing the proceeds and earning taxable interest, dividends, and capital gains, which might mean potentially less GIS.

Advertisement 5

Article content

Naomi, at this stage in your retirement readiness planning it is worth considering a GIS strategy. There may also be other low-income benefits available in your province. Planning around GIS is not easy when you have other assets so you may want to have a discussion with a financial planner.

Allan Norman, M.Sc., CFP, CIM provides fee-only certified financial planning services and insurance products through Atlantis Financial Inc. and provides investment advisory services through Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Canadian Investment Regulatory Organization ciro.ca Allan can be reached at alnorman@atlantisfinancial.ca

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content